Introduction

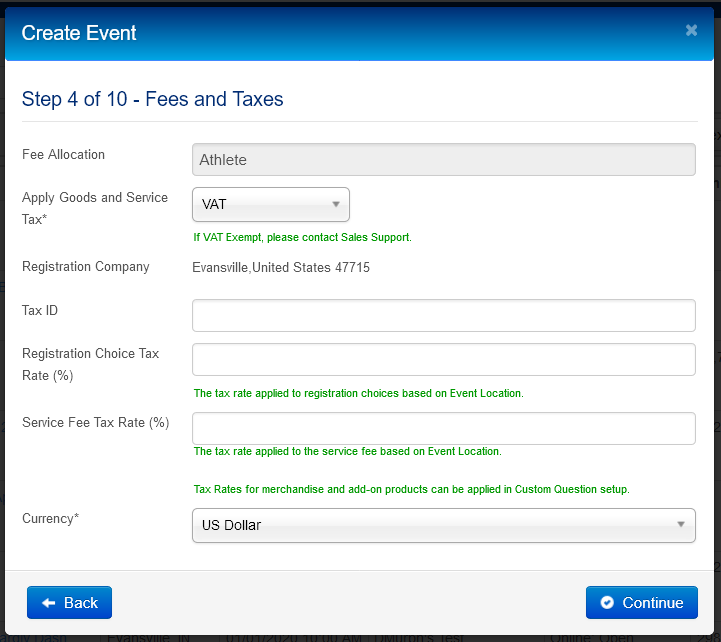

ChronoTrack Live has implemented Value-Added Tax (VAT) for EU countries in addition to an option for all other countries to enter an EIN. The organizing company's Tax ID/EIN and a Registration Choice and Service Fee Tax Rate must now be entered in the Fees and Taxes screen when Creating An Event or when editing Event Properties if your event is in a VAT country. The Country Code where the VAT Tax ID is valid should be entered preceding the actual ID. (For example, 'GB11223344')

Please contact your Account Manager or Regional Sales Manager with questions about VAT.

Any organization using ChronoTrack Live for registration in an EU VAT country MUST be registered with VIES so that we can validate VAT information.

VAT Preparedness

If your event takes place in the EU, it will be a good idea to prepare your VAT information in advance. Gather all of the information in this checklist, and then create your Event. If your

If the Organization is VAT Exempt, you must send a valid VAT exempt form to eusupport@chronotrack.com so that we can disable VAT requirements for your event. This must be done for each event that uses Registration.

- Ensure the Organizing Company has a valid VAT Tax ID in the country in which the event will take place.

- Ensure that the Organizing company is registered with VIES

- Figure out the proper Registration Choice Tax Rate Percentage to apply to the cost of Registration.

- Based on the Reg Choice Tax Rate, calculate the Gross Price to be entered for Registration Choice Pricing

- (If athlete pays Service Fee) Figure out the proper Service Fee Tax Rate Percentage. We recommend setting this the same as the Registration Choice Tax Rate Percentage.

VAT FAQ

- What is VAT?

An article from the European Taxation and Customs union explains VAT like this: “The Value Added Tax, or VAT, in the European Union is a general, broadly based consumption tax assessed on the value added to goods and services. It applies more or less to all goods and services that are bought and sold for use or consumption in the European Union.” To see the complete article, click HERE. - Where is VAT Required?

- My event isn’t happening in the EU. Do I have to enter Sales Tax information?

VAT/Sales Tax information is not required for any aspect of registration in non-VAT countries. - If I’m just scoring my event in ChronoTrack Live, do I still have to enter VAT information?

No - My Organization is VAT exempt. What should I do?

You must send a valid VAT exempt form to eusupport@chronotrack.com so that we can disable VAT requirements for your event. This must be done for each event that uses Registration. - Who pays the collected VAT Tax funds to the enforcing government entities after registration is complete?

It is the sole duty of the Organizer to ensure that all VAT Taxes collected during registration are duly paid to the enforcing government entities in the Country in which the event took place. This does not apply to the Netherlands.

For easy reference, total VAT Tax collected will be reflected in the Fee Details and Net Due reports in your CT Live event. - I need to add VAT information for my existing ChronoTrack Live event. Where do I enter it?

You can enter VAT information in Event Properties under Fees and Taxes. - How do I set my Registration Choice and Custom Question pricing for VAT?

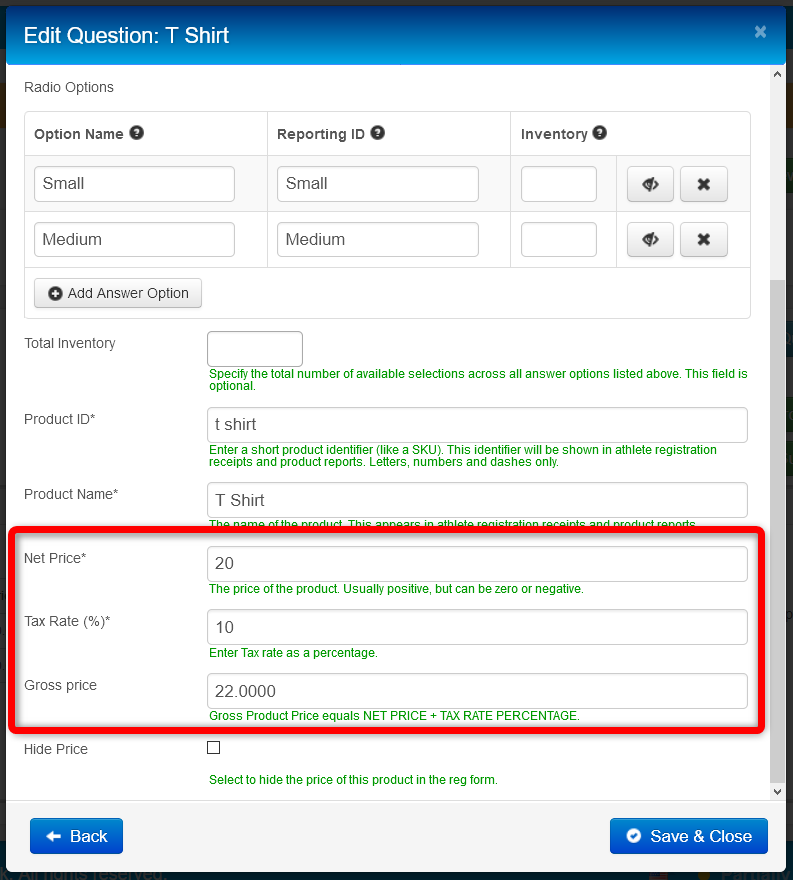

Registration Choice and Custom Question prices should be VAT inclusive, so if the cost of entry for your event is £100 (Net Price) and VAT Fee Percentage is 10%, you would enter a Gross Price of £110 as the cost of registration. You must also set a VAT percentage for the CT Live Processing Fee in Event Properties/when creating a new Event unless the Organizer will be paying the Processing Fee. - My event is happening in a different country than the one in which my company is based. How should VAT be entered?

VAT information should be provided for the country in which the event is taking place. You will need to have a valid VAT ID in that country. - Can I request that the Fee Allocation be changed from Athlete to Event if I have VAT enabled for my event?

Yes. If Fee Allocation is set to "Event", the Organization will pay all CT Live Processing Fees to ChronoTrack/Athlinks. VAT Tax will not be required for the Processing Fee if Fee Allocation is set to "Event" except in the Netherlands. - Can I use Custom Fees if VAT is being applied to my event?

No - Can I use Custom Fees if Sales Tax (not VAT) is being applied to my event?

Yes - Can VAT be applied to Custom Product Questions?

Each Custom Product Question created in a VAT event will have a Net Price, VAT Tax Rate Percentage, and Gross Price field that is required for events in VAT countries unless the organizing company is VAT exempt.

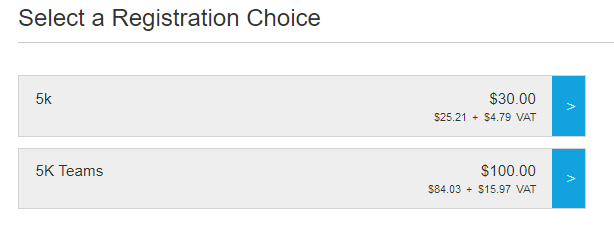

- How is VAT information communicated to athletes DURING registration?

The Registration form will show the VAT amount below each Registration Choice and as the athletes progress through the form.

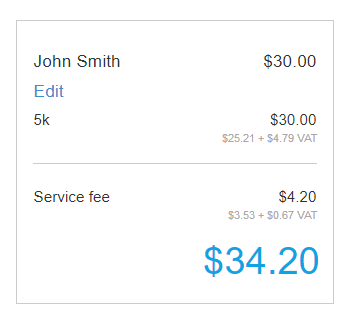

The running total on the right will show VAT for each item in their registration order (Registration Choice, Custom Products, and Service Fee)

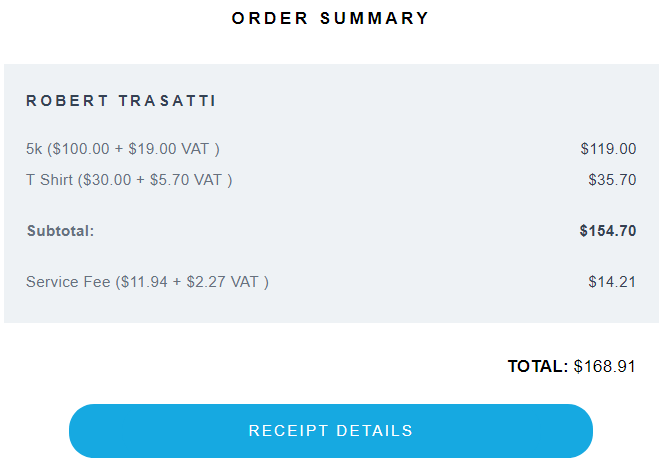

- How is VAT information communicated to athletes AFTER registration?

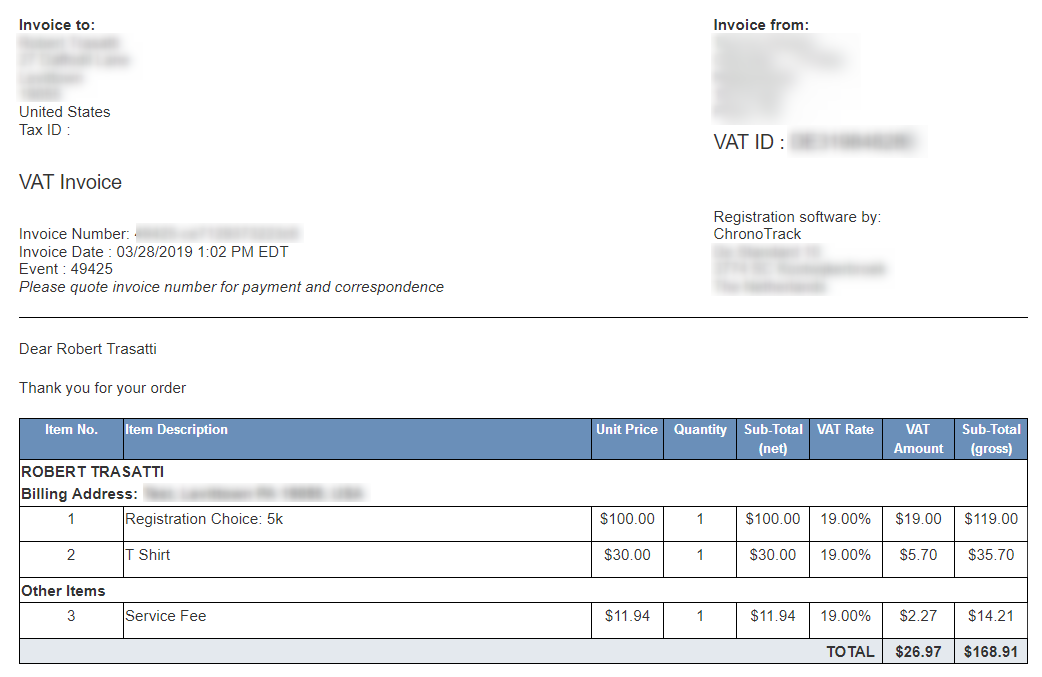

Once an athlete is registered, they will receive the usual confirmation email, and their Order Summary will show amount paid for each registration item plus VAT fee for each.

Fee Allocation: Athlete

Clicking the Receipt Details button will launch a new tab with a detailed VAT Invoice.

Fee Allocation: Athlete