As of January 1st, 2020, ChronoTrack Live will begin enforcing Sales Tax to registrations, merchandise, and the CT Live service fee for Marketplace states where applicable. Our number one goal with Sales Tax implementation is to make sure that our customers and their events are protected from tax liability after the fact and to ensure compliance with changing tax laws.

This FAQ is designed to offer basic practical information on how taxes are collected, what products/services offered through CT Live registration are taxed, and provide links to additional resources. For full details on the why and how of Sales Tax implementation, see our announcement Blog Post.

The FAQ will evolve to include more common questions from users as our Sales Tax implementation evolves. If a question you have concerning Sales Tax isn't answered in this article of the Tax Matrix linked below or the Blog post linked above, please feel free to reach our to Support or your RSM.

In This Tax Matrix, we have laid out more detailed information on whether or not your state is a Marketplace State, and what products and services will be taxed. In addition, the matrix outlines which states and organizations are eligible for tax exemptions.

FAQ

Q: My organization is tax exempt because it is a Nonprofit. How do I disable taxes for my event?

A: While Nonprofits can be exempt from paying sales tax, this does not preclude them from having to collect sales tax in most states. More details are listed in the tax matrix linked above. If you believe you qualify for these exemptions please send your tax exemption papers to accounting@chronotrack.com so we can exclude your event from collecting these fees.

Q: Is there any configuration I need to do to get my event ready to collect Sales Tax?

A: At this time, all handling of Sales Tax collection and remittance is handled by CT Live's accounting department.

Q: Are Donations collected via CT Live's Donations feature taxed?

A: Donations collected through CT Live's built-in Donation feature will not be taxed or used in tax calculations. If you use a Product type Custom Question to collect donations, these WILL be subject to taxation as there is not currently a way to define a Custom Product as charitable giving.

Q: Are Taxes displayed on the Net Due report?

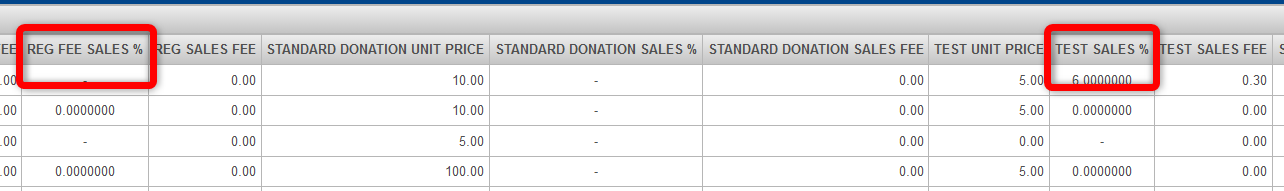

A: Yes. We've added new columns to the NetDue and FeeDetails reports in CT Live that provide tax amounts for each registration transaction type (Reg Fee, Products, CT Live Service Fee). These new columns end with "Sales %" to indicate what percentage applies to each category and "Sales Fee" to indicated how much tax was collected.

Q: When a refund is issued for an athlete's entire registration, will Sales Tax be refunded as well?

A: Yes. Sales tax on the CT Live service fee can only be refunded when the refund is initiated by ChronoTrack staff.

Q: Is Sales Tax displayed on athlete receipts?

A: Yes. New line items detailing total tax collected have been added to the Registration Receipt.

Q: Am I getting less registration revenue now?

A: No. Sales Tax is the responsibility of the athlete and is added to the registration total for each athlete.

Q: Can I include Sales Tax in the registration fee so athletes aren't put off by the additional up-charge?

A: Not yet, but we will be exploring this and other options in the near future.